Table of Content

If you are interested in trying us , get a free quote by calling our helpline or visiting our office. Moreover, evaluate the average insurance cost in other countries and cities. Visit the website of the Department of Insurance to evaluate the costs and rating of your chosen company. Make sure that you are aware of this feature as many policies have high deductibles for certain damages.

Unfortunately, home insurance policies do not cover for the destruction related to earthquakes, floods or poor maintenance. In that case, you might require separate insurances to benefit from these protections. She has a Bachelor’s degree in theatre and is currently pursuing a degree in English with a concentration in professional and technical writing from Indiana University East. Her work has been featured on Reviews.com and Bankrate.com, and she’s passionate about helping people take charge of their finances. In her free time, she likes to read thrillers and sci-fi novels, garden, and toss tennis balls for her dog.

How we make money

TheBureau of Insuranceregulates the insurance industry to protect and serve the people of Maine. A good mortgage rate in Maine depends on your personal situation, so you will need to look into the loan amount you need, your income, existing debts, etc. Are you a homeowner in Maine and perhaps wondering how much home insurance in Maine typically costs? Or maybe you are looking to perhaps save a bit on your home insurance? The average premium amount was sourced from the latest data of the Insurance Information Institute, and the statistical data from the U.S.

Checking first with a homeowner insurance provider will give a homeowner full understanding of what and what is not covered by his homeowner’s policy. Liberty Mutual offers many discounts along with insurance policies which can save you a lot on premiums. You are eligible for these discounts if you have protective devices installed in your home, if you have purchased a new house or if you go for bundle offers like getting home and auto policies together. For further information on what type of coverage you can receive with Allstate’s homeowners insurance, you can call its local agents who are available 24/7. They can help you figure out which policy can cover all your needs and what type of discounts you can get.

What is a good interest rate on a 5/1 adjustable-rate mortgage in Maine?

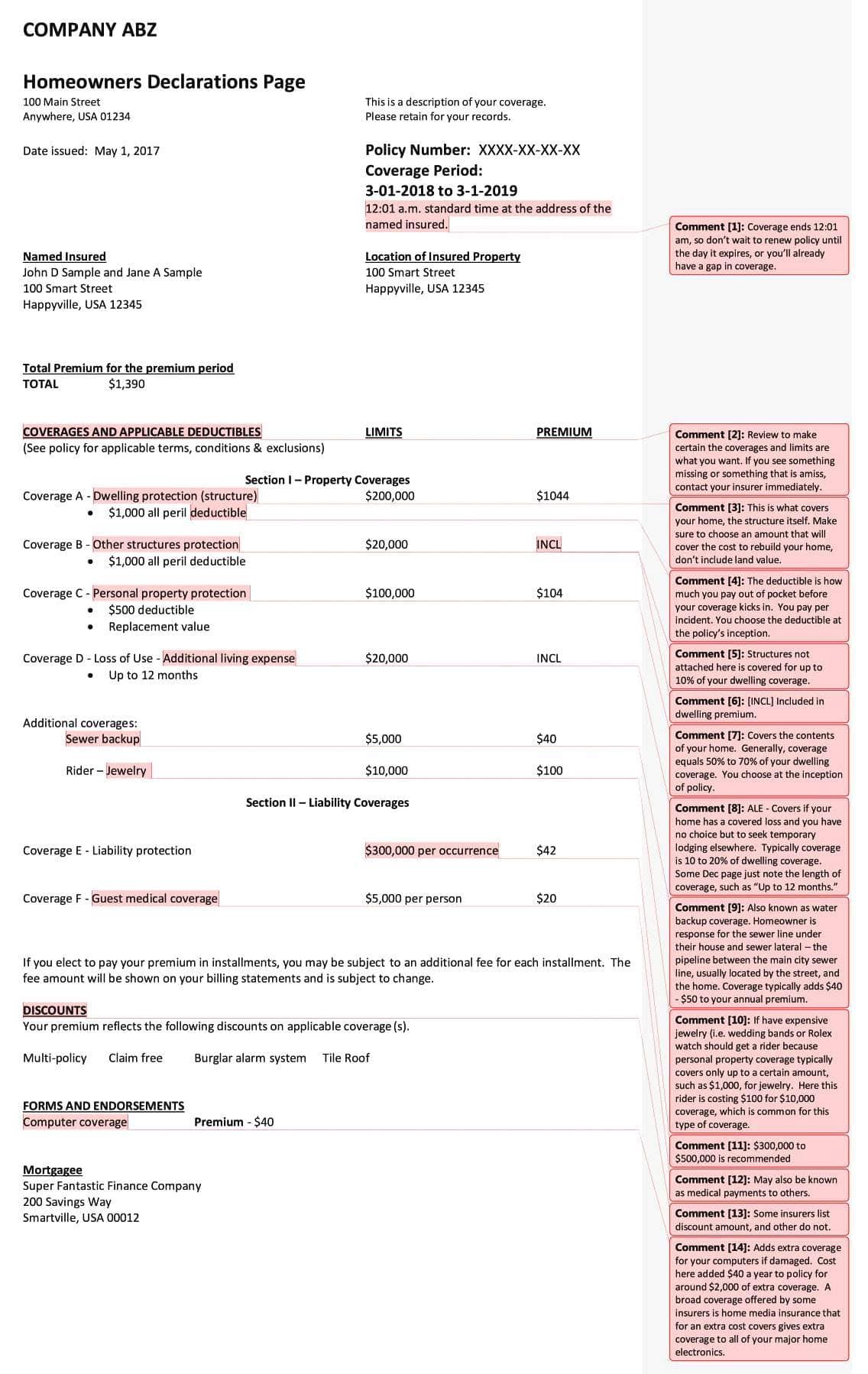

To find the right home insurance policy, compare quotes from a variety of insurance companies. While the rates may be lower on average, homeowners can still find quality insurance coverage for a range of coverage and budget needs. MMG offers comprehensive home insurance and high-quality additional coverages like computer coverage, water backup coverage, and personal injury protection, all at affordable prices. We love MMG because it has a vetted contractor network to help you make repairs after a covered loss, so you won’t have to worry about being taken advantage of during a stressful time. Simply put, it is imperative to get an insurance that provides coverage far more than your house’s current worth. In that case, a guaranteed replacement value policy can easily absorb all the increased home replacement costs and can also provide you with enough support in case there is a rise in construction rates.

Savings, discount names, percentages, availability and eligibility may vary by state. Meet our third party-provided products that allow you to bank when, where and how you want. Previous content is a carousel of 15 images about State Farm history.

Home insurance companies in Maine for poor credit

Homeowners in New Hampshire, for example, pay an average annual premium of $731 per year, and homeowners in Vermont pay an average of $668 per year. This could be because much of Maine is forested and relatively remote, while also incurring significant impacts from Atlantic Ocean weather events, such as tropical cyclones and nor’easters. The average cost of homeowners insurance in Maine is $944 per year for $250,000 in dwelling coverage. Insurance is rapidly evolving to keep pace with our digital world, so these aspects also carried weight in determining Bankrate Scores.

Homeowners insurance in Maine isn’t required by law, but most mortgage lenders will require you to have it. Here are some additional factors that might influence the price of your home insurance in Maine. Covers temporary living expenses if your home is partially or completely damaged and you need to relocate for the time being. Such terms and availability may vary by state and exclusions may apply.

How to save on home and auto insurance

Many companies offer savings of up to 25% when you bundle your home and auto insurance. With average Maine home prices in the $300,000 range, homeowners with dwelling coverage limits of $300,000 can expect to pay $92 each month for home insurance. By comparison, a house with $500,000 of dwelling coverage costs about $145 each month to insure. Vermont Mutual began slinging insurance all the way back in 1828, making it one of the oldest property and casualty insurers in the country. Today, it offers home insurance coverage with a special program for homeowners who run a business from home.

Following are some popular homeowners insurance companies in Maine. Their ratings from AM Best, JD Power and S&P have also been mentioned so that you can get a better picture of the companies. Maine, you’ll want a policy that protects against floods, water and wind damage, wildfires, and other risks.

This profile, assessed across nearly 35,000 ZIP codes in the U.S., provided a basis on which homeowners may compare each provider. Allstate customers know the easiest way to save on coverage is by bundling home and auto insurance policies into a single plan. Another reason Allstate made our list is that it has excellent customer and claims satisfaction ratings from J.D. Power, which means Allstate can be relied upon to be there when customers need them the most.

The company also has a network of local exclusive agents throughout Maine. State Farm’s standard homeowners policy packages include several optional coverage types, like keepsakes coverage and coverage for sports or musical equipment. While State Farm ranked above average for property claims satisfaction, it has a higher-than-baseline consumer complaint index as reported by the National Association of Insurance Commissioners . However, it earned an A++ financial strength rating from AM Best, the highest level achievable.

This site is a free service to assist homeowners in connecting with local service contractors. All contractors are independent and this site does not warrant or guarantee any work performed. It is the responsibility of the homeowner to verify that the hired contractor furnishes the necessary license and insurance required for the work being performed. All persons depicted in a photo or video are actors or models and not contractors listed on this site.

Instead of waiting for bad times to come, prepare yourself to encounter any problems that your home might face in future. At Pine Tree Home Insurance Solutions we make sure to listen to you and give you a helped hand that no other company can offer you. So, for instance, in case of a claim of $10,000, your insurer will pay you $9,000, deducting the $1000 deductible amount. The equipment breakdown endorsement provides coverage for large appliances that might have stopped working for reasons except for regular wear and tear. This endorsement covers all the cost required to bring your house to meet building codes.